All stocks irrespective of industry or sector face some universal risks such as legislative risk, rating risk and headline risk among others. Hence, investors can make smart trading and investment decisions by examining the steps that executives are taking to mitigate the effects of such universal risks on their stocks. Interestingly, the U.S. equity market is vulnerable to serious geopolitical risk; yet, it is surprising that Wall Street is unbelievably oblivious to the problems on the horizon.

2016 was a particularly volatile year for stocks, Forex, and CFDs because of the record level of geopolitical uncertainties that we endured. In 2016, we recorded the surprise Brexit vote in which Britain voted to leave the EU. 2016 ushered in a ‘disruptive’ victory for Donald Trump and it placed Republicans in control of both the Presidency and Congress for the first time in many decades. 2016 also witnessed the rise of populism in Europe with Italy voting to reject constitutional changes by its pro-EU government.

Equities are faced with an unprecedented level of geopolitical risk

This is not a political commentary and I’ll avoid leaning to the left or to the right. However, irrespective of the justifications for Trump’s actions from his supporters and the equally biting accusations from his detractors, investors can agree that Trump is bringing in a new level of unpredictability to the U.S. equities, forex, and CFD markets.

To start with, Trump makes expansive claims with little data or facts to substantiate his assertions. He also miserly with the details of his proposed economic plans; hence, the market is being forced to piece together pieces of information to create a single narrative of ‘Trumponomics’. The problem however is that the absence of details on his economic plans makes it practically impossible to measure the potential effects of such polices on the economy.

Secondly, with Trump, we never really know where we stand with Russia and the uncertainty of our relationship with Russia is probably the biggest wild card in the market right now. Trump says he is a fan of Russian President, Vladmir Putin but Sen. Majority Leader Mitch McConnell says we ain’t buddies with Russia. Trump has said that he intends to “greatly strengthen and expand” the U.S’ nuclear capability and the move could trigger another Cold-War style arms race with its attendant economic war.

Thirdly, Trump has never sugarcoated his distaste for Chinese economic practices and I can only imagine the level of self-control he exerted to refrain from labeling China as a currency manipulator. Nonetheless, it is obvious that Trump wants to correct what he considers an unfair trade relationship with China. In addition, legislation is already underway to help U.S. firms lodge complaints about unfair subsidies against Chinese products that have an undue advantage because of the artificially low Yuan.

Why is Wall Street oblivious to the risks facing the market?

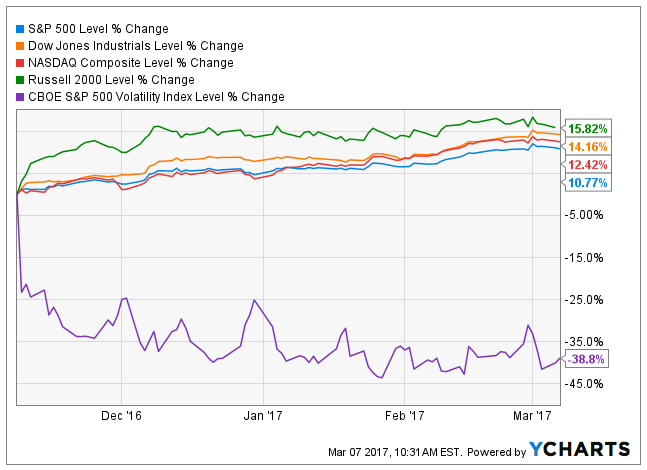

The chart above shows how U.S. equities have fared since Trump won the presidential election last year. The S&P 500 has gained 10.76%, the NASDAQ Composite has gained 12.45%, the Dow Jones Industrial is up an impressive 14.15%, and small cap stocks represented in the Russell 2000 are up by 15.82%.

From the foregoing, it is obvious that U.S. stocks are booking gains. The gains contrast with the weakness that should have followed the uncertainties that Trump is triggering. Interestingly, the VIX Index (purple line), which measures the level of fear and uncertainty in U.S. equities is down 38.8% since Trump won the election.

It seems that Wall Street is choosing to ignore the geopolitical risks that Trump pose to the markets by being fixed on his business-oriented policies. However, researchers at PIMCO sum the potential vulnerability points in the market in the following words. “The world economy and markets have embarked on a journey into the unknown… Our confidence in any particular scenario is low. The reason: the world has now fully arrived in the radically uncertain, ‘stable but not secure’ predicament.”

In spite of the reasons for concern you so capably enumerate it feels like making defensive investment moves would be timing the market. I’m trying to ignore the uncertainty and just keep on keeping on with a balanced portfolio. I just don’t know a historically proven better way to go.